Why You Should Pay Your Taxes with Credit Cards

By John Ta - December 11, 2023

Despite the IRS processing fee, the potential rewards and points earned from using your credit card might just outweigh the costs.

This article is not intended as tax advice and is for informational purposes only. Consult a tax professional for advice specific to your situation

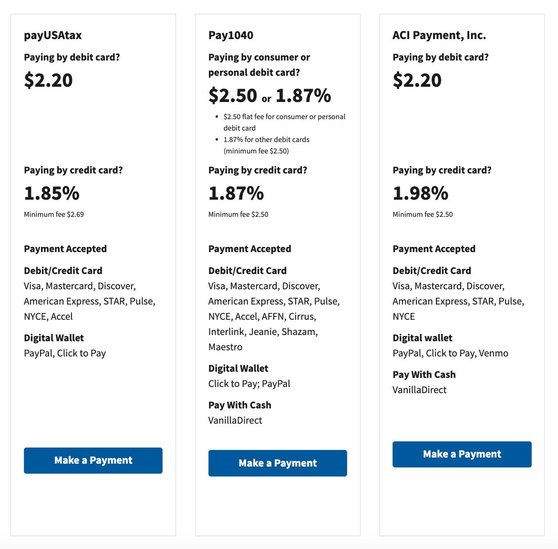

Oh no! Uncle Sam is coming to each of our doors soon, requesting you pay for your fair share of taxes. The IRS provides several convenient options to pay your taxes: directly from your bank account, via a debit/credit card, or through a digital wallet. However, payments made via cards or digital wallets incur processing fees. For example, a $1,000 tax payment will include an additional $20 fee.

If you need to pay a processing fee, why might it make sense to pay your taxes via credit card? Put simply, you may earn rewards & points that offset the processing fees entirely (and more!).

Here's a comprehensive look at why you might consider this method, as well as some potential downsides with some real life examples:

What do Credit Card Companies Think of This?

Surprisingly, some credit card companies generally view the use of credit cards for tax payments favorably, as it aligns with their broader business model of encouraging spending through credit. In fact, Chase has dedicated a page to highlight the pros and cons of tax payments via credit card, stating, “If you value the convenience of using a credit card or find an attractive signup bonus offer, consider using your card.”

Even AMEX, known to be notorious for its clawbacks and stinginess with points, has rewarded points for tax payments.

Furthermore, many reputable sources have commented on this matter in great detail, including The Points Guy, Forbes, Nerdwallet… in short: credit card companies are ok with cardholders paying their taxes with credit cards.

The IRS charges fees for using credit cards to pay taxes.

Pros of Paying Taxes with a Credit Card

- Earn Rewards and Points: Most credit cards will reward tax payments with points at their lowest rate for “all eligible purchases.” While many cards will only give 1x points per dollar, some cards like the Chase Freedom Unlimited or the AMEX Blue Business® Plus Credit Card will give 1.5x or 2x on all spend, helping to offset the processing fees altogether (if you value points at higher than 1 cent per point)

- Meeting Minimum Spend for Bonuses: If you have a new credit card that offers a sign-up bonus after spending a certain amount within a specific timeframe, paying taxes can help you meet that threshold more quickly.

- Extended Payment Time & Liquidity: If you're short on liquid funds when taxes are due, a credit card can provide a short-term solution. This allows you to manage cash flow more effectively, especially if you anticipate having the funds to pay off the credit card before interest accrues. You can even use a 0% interest APR offer seen with cards like the Chase Freedom Unlimited to defer the tax liability until later!

- Convenience and Simplicity: Paying taxes with a credit card is straightforward and can be done online. This convenience is a significant draw for those who prefer digital transactions over traditional methods like checks or bank transfers.

- Hitting Spending Thresholds: Some cards offer unique bonuses for individuals who can hit certain spending thresholds. For example, the IHG Premier gives cardholders IHG Diamond status if they put $40,000 of spend on the card a year. Making a large tax payment might be able to help you hit said goals.

Cons of Paying Taxes with a Credit Card

- Processing Fees: The IRS authorizes several payment processors to collect tax payments by credit card, and they all charge a ~2% fee. This fee can offset any rewards earned, making it less financially beneficial.

- High-Interest Rates: If you’re unable to pay off your credit card balance immediately, the interest charges can quickly surpass the amount of any rewards earned. Credit card interest rates are usually much higher than any potential penalties for a late tax payment plan arranged with the IRS.

- Potential for Debt: Using a credit card to pay taxes can lead to substantial debt, particularly if you're unable to pay off the balance quickly. This risk is amplified for those who already have high credit card balances.

- Impact on Credit Score: Large balances, even if temporary, can affect your credit utilization ratio, potentially impacting your credit score negatively.

- No IRS Installment Agreement Eligibility: If you pay by credit card, you may not be eligible for an IRS installment agreement, which often has lower interest rates than a credit card.

What Are Some Examples of Rewards I Can Get?

IHG One Rewards Premier Credit Card

The IHG Premier card offers several awesome spending thresholds after you spend these amounts each calendar year:

- $20,000: Earn a $100 statement credit and 10,000 bonus points

- $40,000: Qualify for IHG Diamond Elite status through December 31st of the following calendar year

Let’s say you put $40,000 on this card for your tax payments. What would that cost/benefit you, assuming a ~2% processing fee?

Cost

- 2% processor fee: $800

- Potential opportunity cost: ~$666

Benefit

- 120,000 IHG points

- $100 statement credit

- 10,000 bonus IHG points

- IHG Diamond Status for the remainder of the following calendar year

Interestingly, despite the $700 out of pocket cost (after accounting for the $100 statement credit), you’d earn a significant swathe of points and benefits. Given TPG’s valuation of IHG points at 0.5 cents each, it’s pretty safe to say that you’re earning roughly $650 worth of points and IHG’s top tier status for just $700—seems like quite the deal to me.

Marriott Bonvoy Boundless® Credit Card

- Earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend

- Spend $35,000 to earn Gold Elite Status per calendar year

While many would agree that spending $35,000 for Gold status is a bit much (Gold status is very easy to acquire with the right credit cards), the ability to earn a few Elite Night Credits to hit a status goal (especially near the end of a calendar year) could be tremendous.

For example, let’s say you needed 3 more nights to hit Marriott’s Titanium elite status, but you don’t have any upcoming stays. If you put $15,000 of tax spend on your Marriott Bonvoy Boundless card, you’d be encountering the following cost/benefit table:

Cost

- 2% processor fee: $300

- Potential opportunity cost: ~$100

Benefit

- 3 elite qualifying nights

- Marriott Titanium Elite Status (4th highest public tier)

- 30,000 Marriott points

This is an interesting analysis. TPG values Marriott points at 0.84 cents each, suggesting that 30,000 Marriott points is worth ~$252. This leaves an “effective” cost of $148. However, if you consider the alternatives to getting 3 elite qualifying nights, this might be worth doing, especially since you end up with Marriott Titanium elite status.

What Happens If I Overpay My Taxes? Where Does My Money Go?

Your money doesn’t disappear into the abyss (that would be sad). The excess amount becomes a credit with the IRS, leading to a few possible outcomes depending on your situation and preferences.

- Refund: The most common result of overpaying taxes is receiving a refund. The IRS will calculate the overpaid amount and issue a refund to you. You can choose to receive this refund either as a direct deposit into your bank account, which is the fastest method, or as a mailed check.

- Apply to Future Taxes: Instead of receiving a refund, you can opt to apply the overpaid amount to your future tax liabilities. However, this option is not recommended since it essentially gives the government an interest free loan with your money, further increasing the opportunity cost of paying your taxes with a credit card.

- Amended Returns and Adjustments: In some cases, if you discover the overpayment after filing, you may need to file an amended tax return using Form 1040-X. This process can adjust your tax liability and lead to a refund or application to future taxes.

- Interest on Overpayment: The IRS may pay interest on the overpaid tax if the refund is not issued within a certain timeframe, typically 45 days from the filing deadline or the date you filed your return, whichever is later. This interest is considered taxable income for the year it's received. Notably, IRS interest rates for overpayments can completely offset the opportunity cost of storing your money elsewhere. See the IRS websites for rates.

- Settle Existing Debts: If you have other outstanding federal or state debts, such as past-due federal taxes, state income tax, child support, or federal non-tax debts (like student loans), the IRS may use your overpaid tax to offset these debts before issuing a refund or applying it to future taxes.

Conclusion

Paying taxes with a credit card can be a strategic move for earning huge rewards and managing cash flow, especially if you can avoid interest by paying off the balance promptly. However, the potential downsides, like processing fees and high-interest rates, should be carefully weighed. It's crucial to assess your financial situation, the rewards of your credit card, and the fees involved to determine if this method of tax payment is the right choice for you.

Get the free daily email of the latest award flight deals.